HOME

BLOG

2023 Insights: International Children's Content Performance in China

2023 Insights: International Children's Content Performance in China

Manya

Feb 9, 2024

Introduction

Whether in China or abroad, the post-pandemic year of 2023 was a year of continued economic fragility. The children's content industry was similarly impacted, with industry insiders often mentioning a few key pieces of information during discussions: "Some platforms are tightening their budgets, some are only acquiring commercial programs or even only opting for top-tier content."

So, is the situation the same in the Chinese market? Did the major platforms introduce less overseas content in 2023 compared to 2022? Apart from well-known IPs like "Peppa Pig" and "Paw Patrol", which new overseas programs performed the best this year? Among the 4 major platforms (Youku, Tencent, iQIYI, Mango TV), which one acquired the most overseas content? Which platform had more exclusive broadcasts and co-productions? What type of children's content is most liked in the Chinese market? Let's take a deep dive for those questions!

New Program Releases: Youku shines the brightest

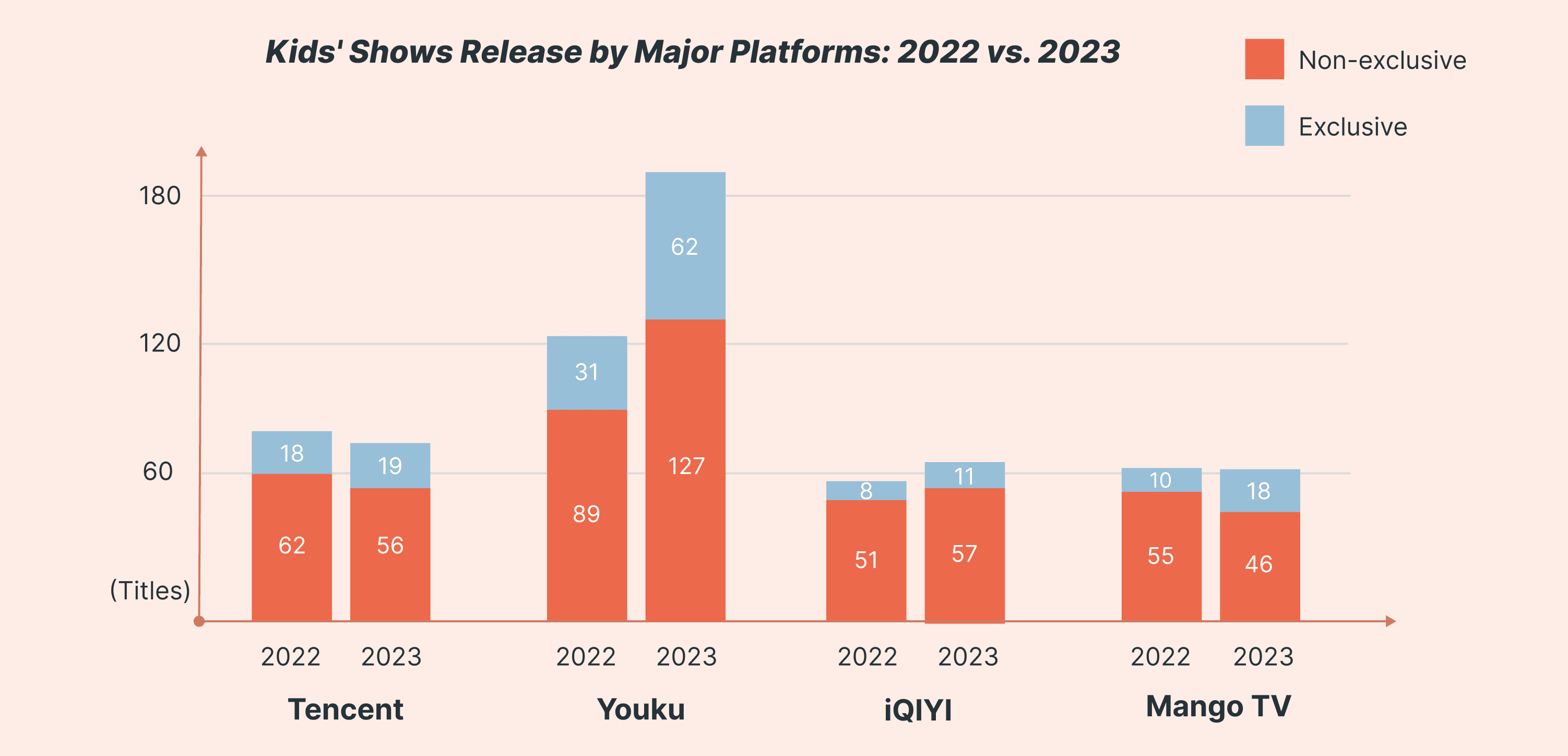

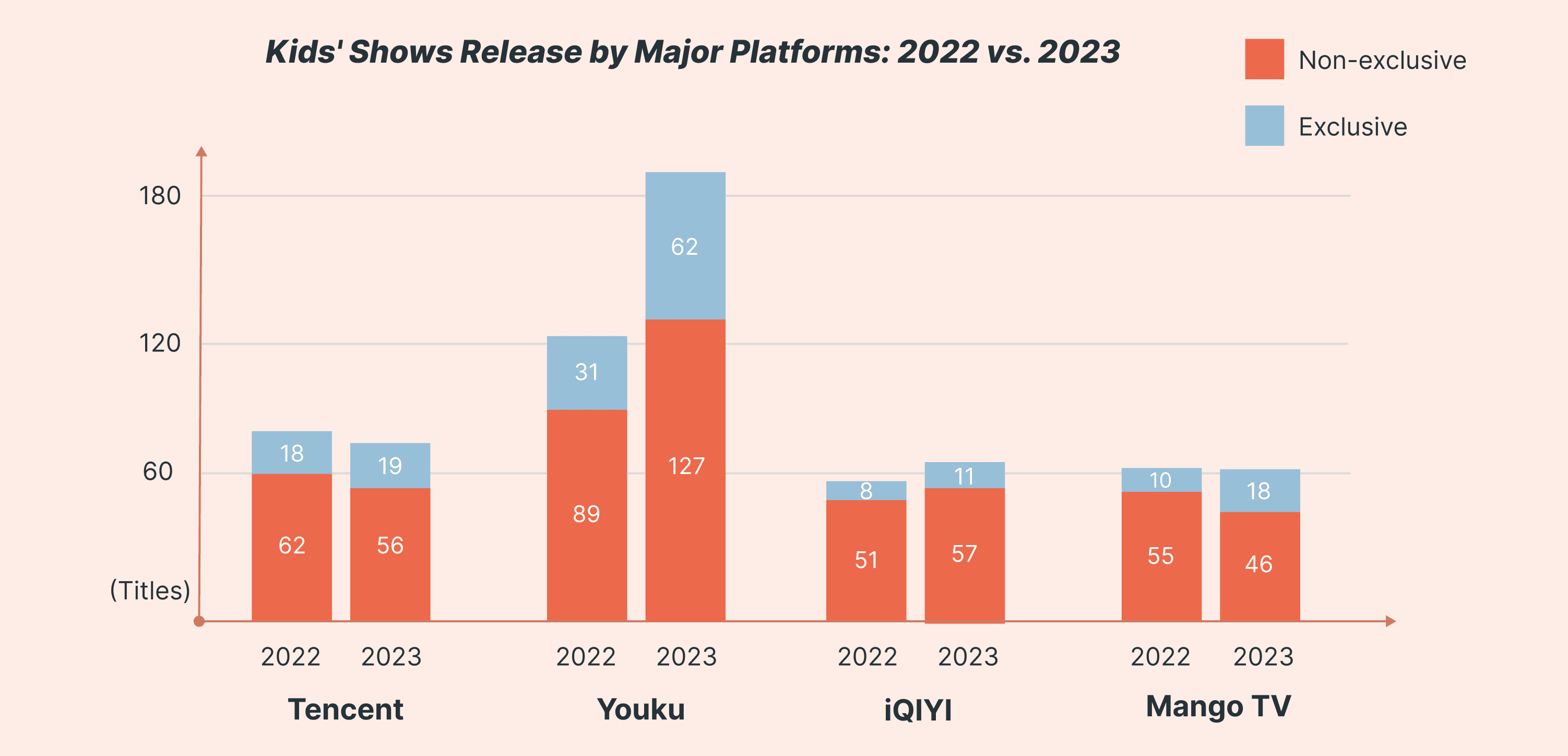

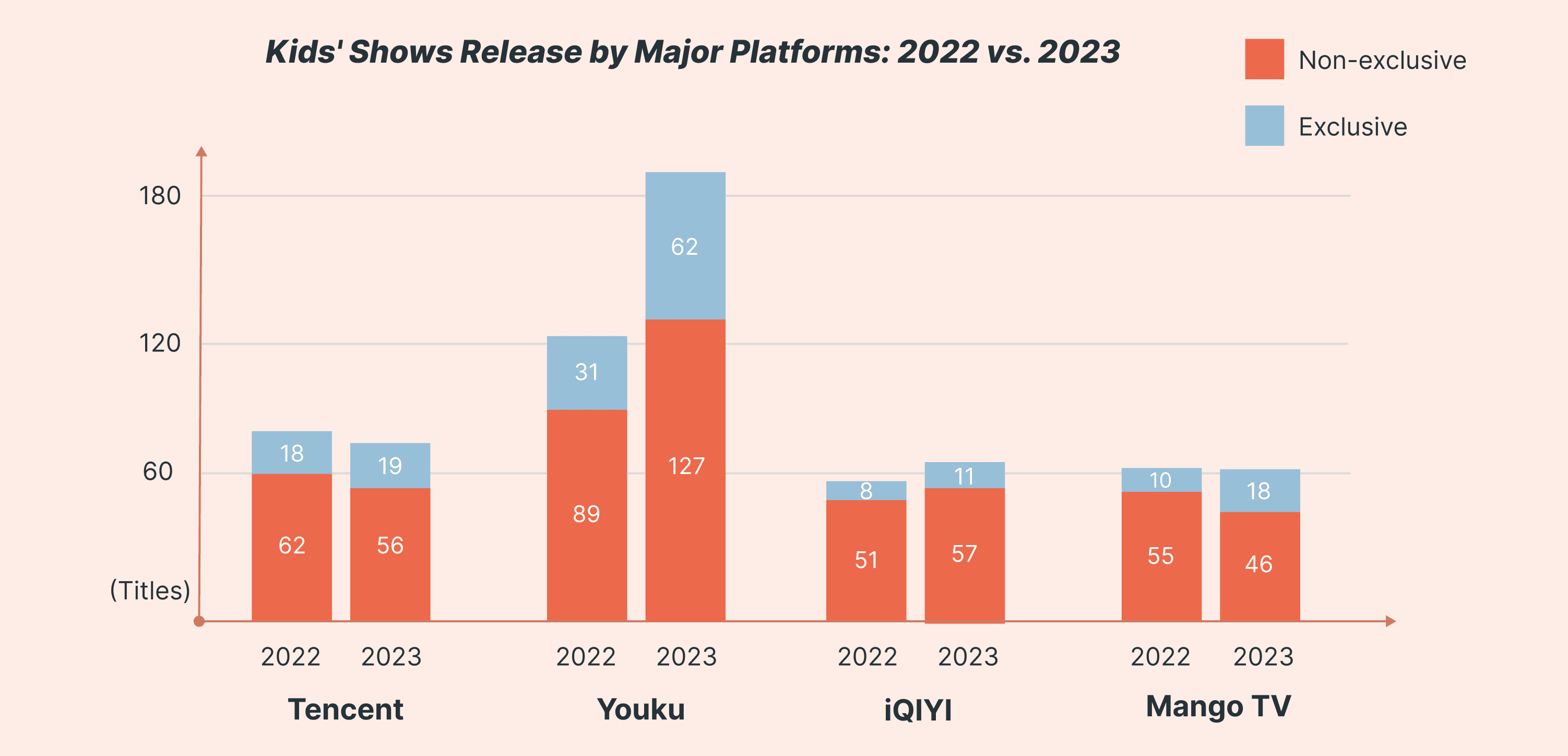

In 2023, Youku led the way with a staggering 189 new programs, far ahead of the other 3 platforms: which Tencent at 75, iQIYI at 68, and Mango TV at 64 new programs, not even half of Youku's number. A comparison reveals that Youku was already leading in program introductions in 2022: while the other three platforms maintained their acquisition volume from the previous year, Youku's purchases in 2023 still grew by nearly 60%.

Among all new program releases, one-third on Youku were exclusive broadcasts, with iQIYI having the fewest. Looking at the data from 2022, we find that the number of exclusive broadcasts on Youku and Mango TV doubled in 2023, with slight increases on the other 2 platforms.

International Acquisition: Programs from the UK, France, and the US most popular

We examined the proportion of overseas content among the new programs on each platform: Youku 24%, Tencent 13%, Mango TV 12%, iQIYI 8%. We also compared this data with 2022, finding that aside from Youku, the other three platforms all reduced their proportion and number of overseas content acquisitions in 2023. This could be related to the Chinese National Radio and Television Administration's auditing and quota restrictions on overseas programs, as well as tighter acquisition budgets across the platforms.

Notably, programs from the UK, France, the United States, and Canada were most favored by the platforms. We rarely observe the acquisition of children's animations from countries like South Korea and Japan; in fact, many Korean programs are often presented as Chinese properties when they come to China due to political restrictions.

International Programs Performance: Top 2 are Slapsticks

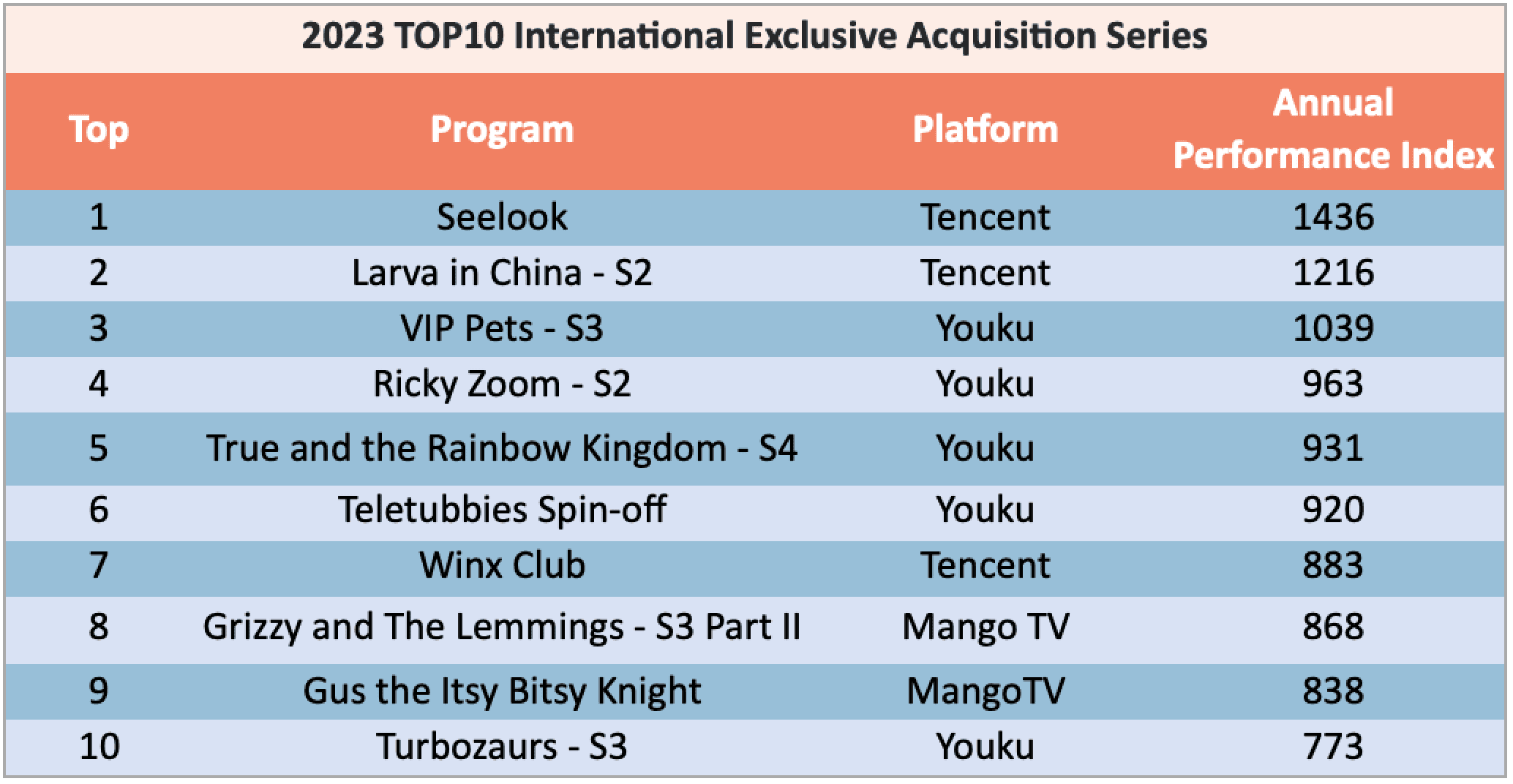

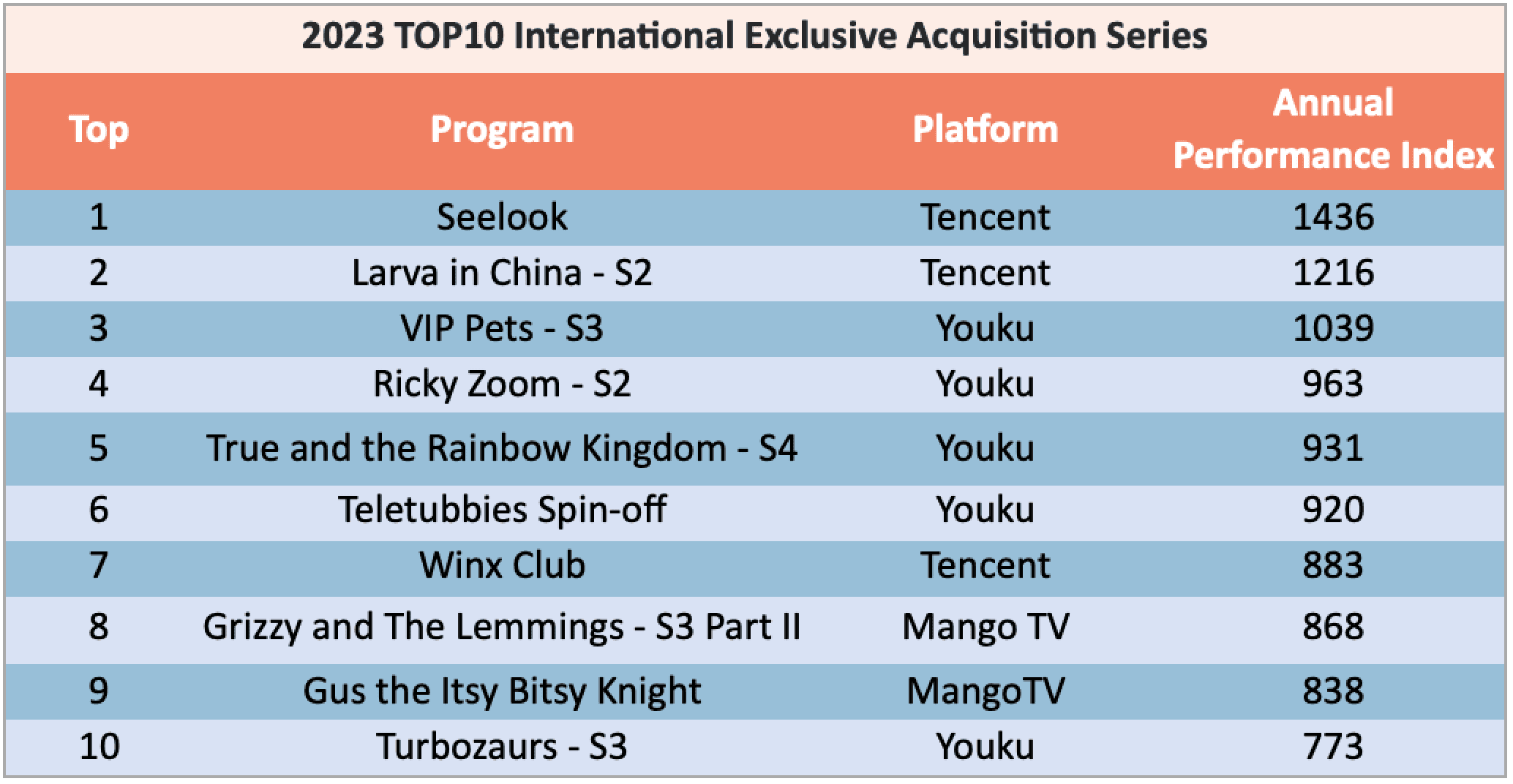

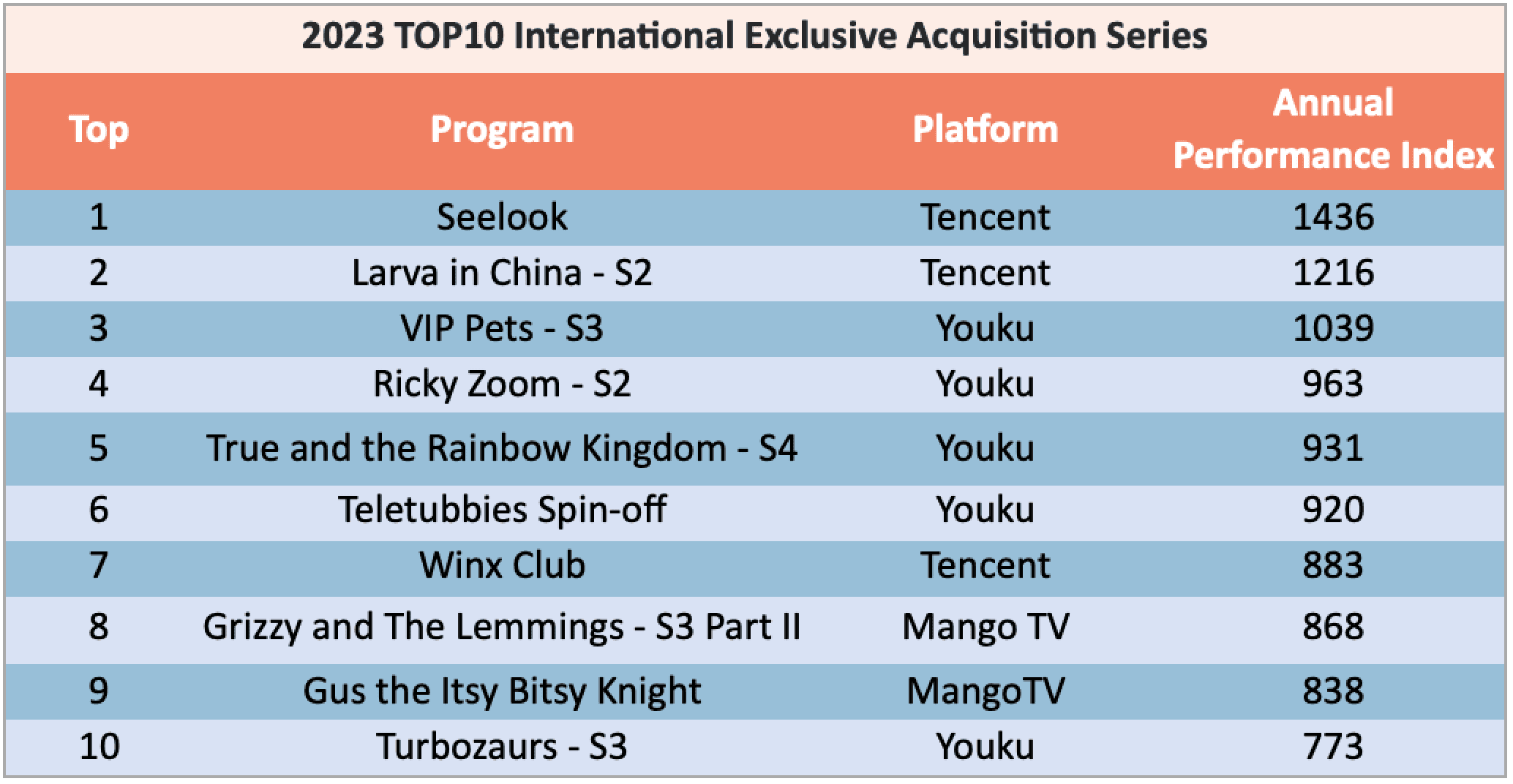

Let's look at the rankings of exclusive overseas broadcast content (excluding self/co-produced content) across the platforms:

Half of the top 10 programs are from Youku. The top 2 ranked programs, "Seelook" and "Larva in China S2," are slapsticks, with Mango TV's exclusive "Grizzy and the Lemmings" also in the same category. Additionally, "VIP Pets," "Ricky Zoom," and "True and the Rainbow Kingdom" performed remarkably well.

*Annuel Performance Index: A comprehensive measure of views, comments, searches, and trend in Series

International Coproduction: Youku leads with diverse global partnerships

In 2023, Youku had 18 self-produced or co-production programs go live, 7 of which were joint productions with overseas animation companies: including the “Lupin’s Tales” new seasons co-produced with France's Xilam driven and coordinated by Midolala; the "Tina & Tony" series with Russia's Riki Group; the "True and the Rainbow Kingdom" series co-produced with Guru; and "Turbozaurs" with Cyprus's Treblo Media.

Tencent Video had 8 co-production projects, only one of which was a collaboration with an overseas company: "Super Potato" from BBC Kids&Family, with the other 7 being domestic co-productions. All 9 children's content productions by iQIYI were domestic.

Overall Performance: Content aimed at girls being the most popular

"Commercialization" is a keyword in the Chinese market in 2023, with all major platforms seeking children's content with strong commercial elements, for a very straightforward reason: high return on investment. So, what type of content was most beloved by Chinese children this year?

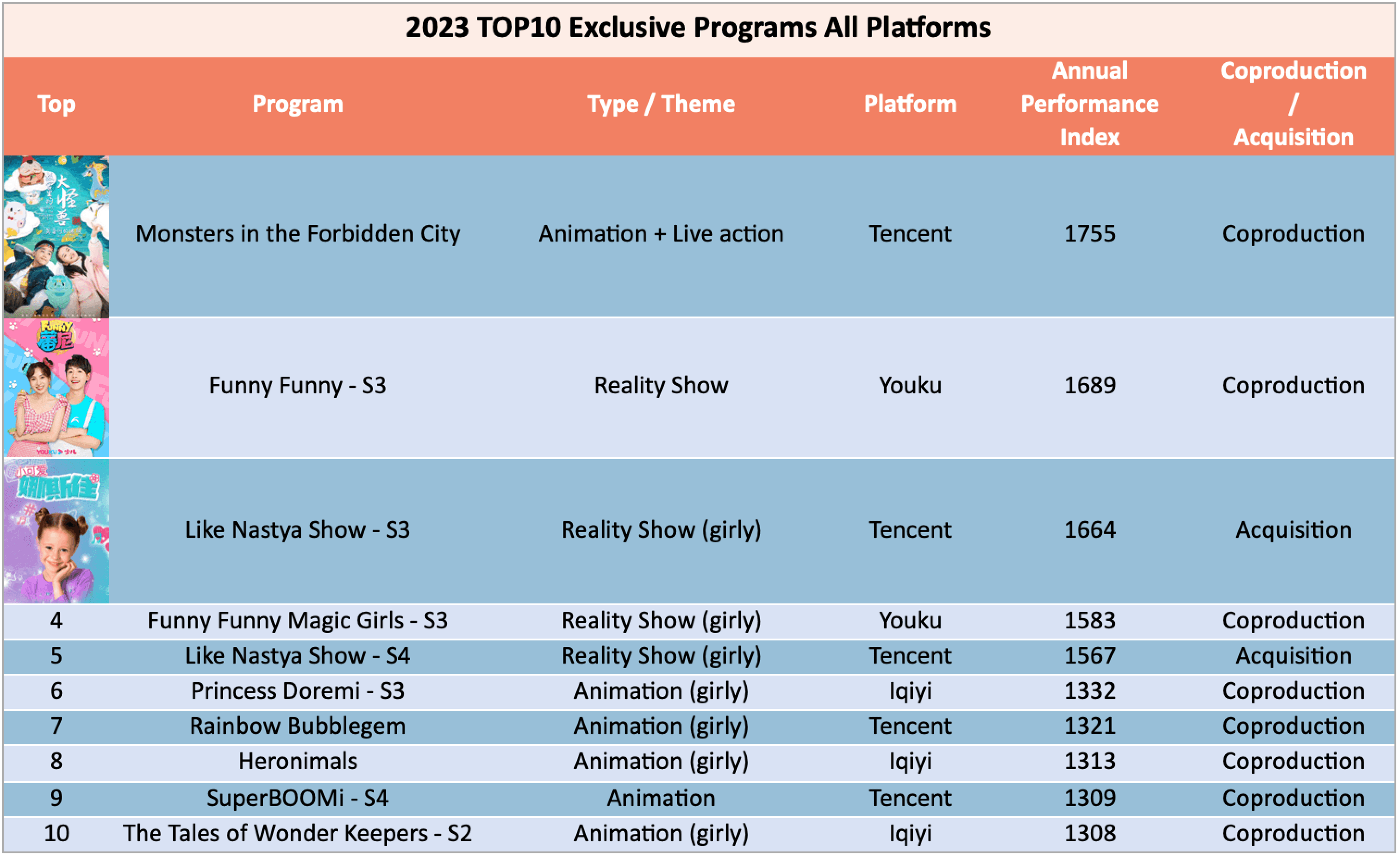

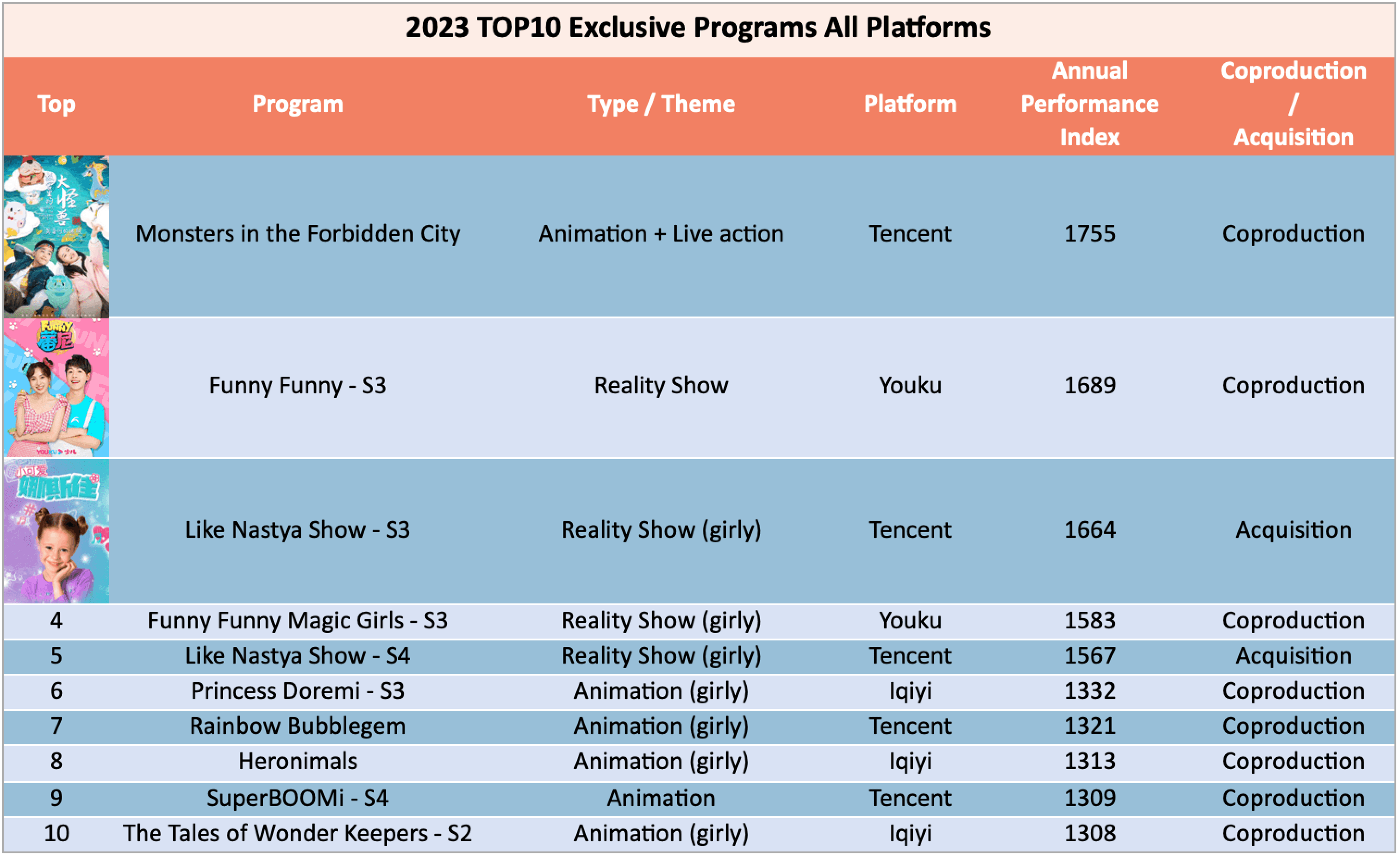

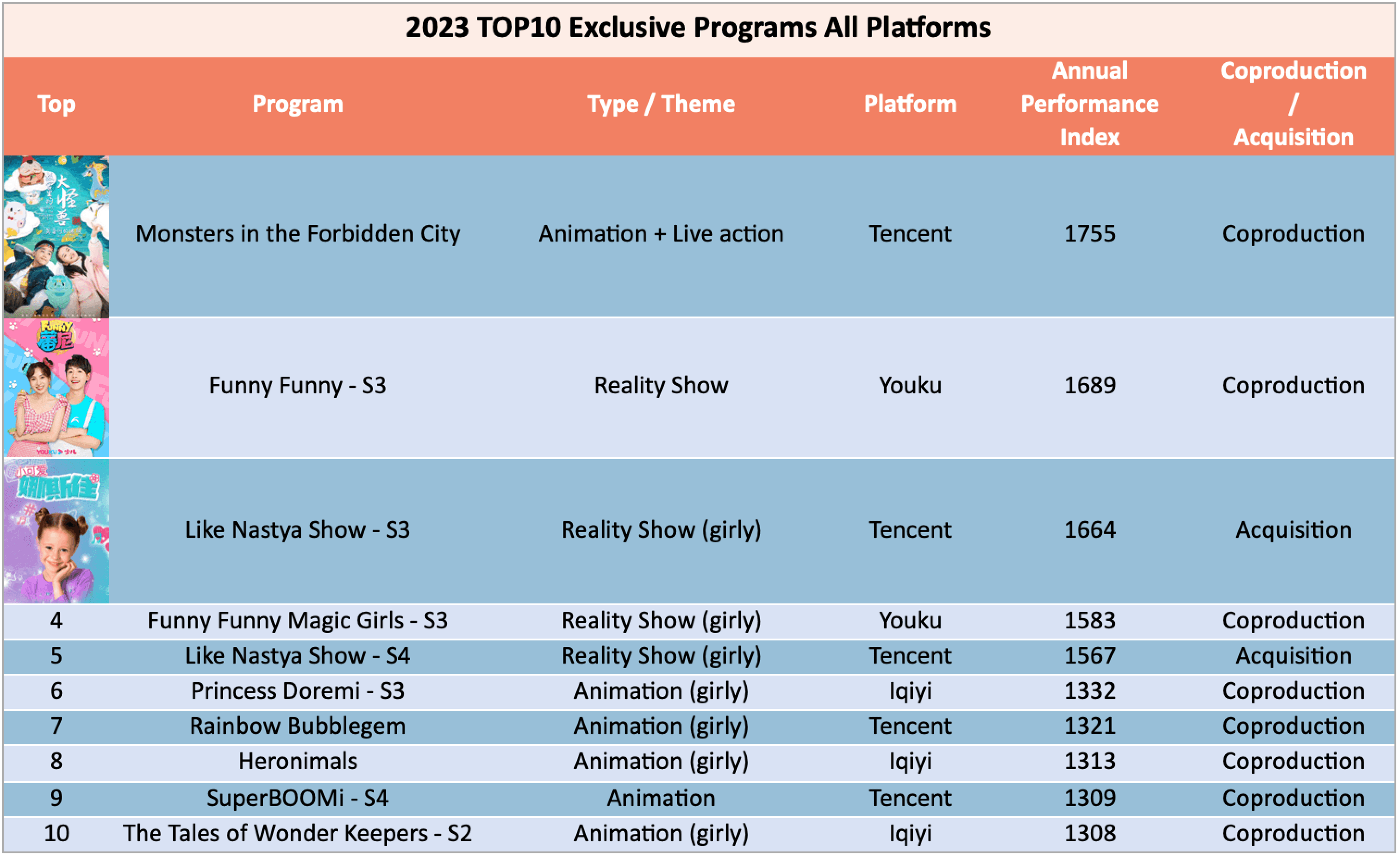

Half of the top 10 content comes from Tencent, with iQIYI holding 3 spots, and Youku 2. In the overall ranking of exclusive broadcasts, domestic programs accounted for 8 spots, while overseas programs held 2.

7 spots are occupied by the same genre: content aimed at girls. iQIYI performed exceptionally in this category, with all 3 of its programs being girl-themed and self-produced.

Surprisingly, the types of programs ranked 2nd to 5th are all reality shows: Youku's in-house-produced "Fanny" series and Tencent's introduced "Like Nastya" are particularly noteworthy, and the NO.1 ranked "Monsters in the Forbidden City" also presents a blend of live-action and animation.

Based on market playback feedback, the most popular themes in 2023 were undoubtedly content aimed at girls and kids' reality shows.

Final Thoughts

Overall, 2023 was a better year than 2022, with the budgets and numbers of content acquisitions by various platforms at least maintaining the level of the previous year, even showing an upward trend. In terms of business models, besides acquiring licensing rights, platforms also increasingly value PGC (Professional Generated Content) collaborations under the initiative of "reducing costs and increasing efficiency": sharing ongoing profits with rights holders based on the actual performance of the program.

*Statistic ressource : Youku, Tencent, IQiyi, Mango TV platforms & Nian Tong Kids

Introduction

Whether in China or abroad, the post-pandemic year of 2023 was a year of continued economic fragility. The children's content industry was similarly impacted, with industry insiders often mentioning a few key pieces of information during discussions: "Some platforms are tightening their budgets, some are only acquiring commercial programs or even only opting for top-tier content."

So, is the situation the same in the Chinese market? Did the major platforms introduce less overseas content in 2023 compared to 2022? Apart from well-known IPs like "Peppa Pig" and "Paw Patrol", which new overseas programs performed the best this year? Among the 4 major platforms (Youku, Tencent, iQIYI, Mango TV), which one acquired the most overseas content? Which platform had more exclusive broadcasts and co-productions? What type of children's content is most liked in the Chinese market? Let's take a deep dive for those questions!

New Program Releases: Youku shines the brightest

In 2023, Youku led the way with a staggering 189 new programs, far ahead of the other 3 platforms: which Tencent at 75, iQIYI at 68, and Mango TV at 64 new programs, not even half of Youku's number. A comparison reveals that Youku was already leading in program introductions in 2022: while the other three platforms maintained their acquisition volume from the previous year, Youku's purchases in 2023 still grew by nearly 60%.

Among all new program releases, one-third on Youku were exclusive broadcasts, with iQIYI having the fewest. Looking at the data from 2022, we find that the number of exclusive broadcasts on Youku and Mango TV doubled in 2023, with slight increases on the other 2 platforms.

International Acquisition: Programs from the UK, France, and the US most popular

We examined the proportion of overseas content among the new programs on each platform: Youku 24%, Tencent 13%, Mango TV 12%, iQIYI 8%. We also compared this data with 2022, finding that aside from Youku, the other three platforms all reduced their proportion and number of overseas content acquisitions in 2023. This could be related to the Chinese National Radio and Television Administration's auditing and quota restrictions on overseas programs, as well as tighter acquisition budgets across the platforms.

Notably, programs from the UK, France, the United States, and Canada were most favored by the platforms. We rarely observe the acquisition of children's animations from countries like South Korea and Japan; in fact, many Korean programs are often presented as Chinese properties when they come to China due to political restrictions.

International Programs Performance: Top 2 are Slapsticks

Let's look at the rankings of exclusive overseas broadcast content (excluding self/co-produced content) across the platforms:

Half of the top 10 programs are from Youku. The top 2 ranked programs, "Seelook" and "Larva in China S2," are slapsticks, with Mango TV's exclusive "Grizzy and the Lemmings" also in the same category. Additionally, "VIP Pets," "Ricky Zoom," and "True and the Rainbow Kingdom" performed remarkably well.

*Annuel Performance Index: A comprehensive measure of views, comments, searches, and trend in Series

International Coproduction: Youku leads with diverse global partnerships

In 2023, Youku had 18 self-produced or co-production programs go live, 7 of which were joint productions with overseas animation companies: including the “Lupin’s Tales” new seasons co-produced with France's Xilam driven and coordinated by Midolala; the "Tina & Tony" series with Russia's Riki Group; the "True and the Rainbow Kingdom" series co-produced with Guru; and "Turbozaurs" with Cyprus's Treblo Media.

Tencent Video had 8 co-production projects, only one of which was a collaboration with an overseas company: "Super Potato" from BBC Kids&Family, with the other 7 being domestic co-productions. All 9 children's content productions by iQIYI were domestic.

Overall Performance: Content aimed at girls being the most popular

"Commercialization" is a keyword in the Chinese market in 2023, with all major platforms seeking children's content with strong commercial elements, for a very straightforward reason: high return on investment. So, what type of content was most beloved by Chinese children this year?

Half of the top 10 content comes from Tencent, with iQIYI holding 3 spots, and Youku 2. In the overall ranking of exclusive broadcasts, domestic programs accounted for 8 spots, while overseas programs held 2.

7 spots are occupied by the same genre: content aimed at girls. iQIYI performed exceptionally in this category, with all 3 of its programs being girl-themed and self-produced.

Surprisingly, the types of programs ranked 2nd to 5th are all reality shows: Youku's in-house-produced "Fanny" series and Tencent's introduced "Like Nastya" are particularly noteworthy, and the NO.1 ranked "Monsters in the Forbidden City" also presents a blend of live-action and animation.

Based on market playback feedback, the most popular themes in 2023 were undoubtedly content aimed at girls and kids' reality shows.

Final Thoughts

Overall, 2023 was a better year than 2022, with the budgets and numbers of content acquisitions by various platforms at least maintaining the level of the previous year, even showing an upward trend. In terms of business models, besides acquiring licensing rights, platforms also increasingly value PGC (Professional Generated Content) collaborations under the initiative of "reducing costs and increasing efficiency": sharing ongoing profits with rights holders based on the actual performance of the program.

*Statistic ressource : Youku, Tencent, IQiyi, Mango TV platforms & Nian Tong Kids

Introduction

Whether in China or abroad, the post-pandemic year of 2023 was a year of continued economic fragility. The children's content industry was similarly impacted, with industry insiders often mentioning a few key pieces of information during discussions: "Some platforms are tightening their budgets, some are only acquiring commercial programs or even only opting for top-tier content."

So, is the situation the same in the Chinese market? Did the major platforms introduce less overseas content in 2023 compared to 2022? Apart from well-known IPs like "Peppa Pig" and "Paw Patrol", which new overseas programs performed the best this year? Among the 4 major platforms (Youku, Tencent, iQIYI, Mango TV), which one acquired the most overseas content? Which platform had more exclusive broadcasts and co-productions? What type of children's content is most liked in the Chinese market? Let's take a deep dive for those questions!

New Program Releases: Youku shines the brightest

In 2023, Youku led the way with a staggering 189 new programs, far ahead of the other 3 platforms: which Tencent at 75, iQIYI at 68, and Mango TV at 64 new programs, not even half of Youku's number. A comparison reveals that Youku was already leading in program introductions in 2022: while the other three platforms maintained their acquisition volume from the previous year, Youku's purchases in 2023 still grew by nearly 60%.

Among all new program releases, one-third on Youku were exclusive broadcasts, with iQIYI having the fewest. Looking at the data from 2022, we find that the number of exclusive broadcasts on Youku and Mango TV doubled in 2023, with slight increases on the other 2 platforms.

International Acquisition: Programs from the UK, France, and the US most popular

We examined the proportion of overseas content among the new programs on each platform: Youku 24%, Tencent 13%, Mango TV 12%, iQIYI 8%. We also compared this data with 2022, finding that aside from Youku, the other three platforms all reduced their proportion and number of overseas content acquisitions in 2023. This could be related to the Chinese National Radio and Television Administration's auditing and quota restrictions on overseas programs, as well as tighter acquisition budgets across the platforms.

Notably, programs from the UK, France, the United States, and Canada were most favored by the platforms. We rarely observe the acquisition of children's animations from countries like South Korea and Japan; in fact, many Korean programs are often presented as Chinese properties when they come to China due to political restrictions.

International Programs Performance: Top 2 are Slapsticks

Let's look at the rankings of exclusive overseas broadcast content (excluding self/co-produced content) across the platforms:

Half of the top 10 programs are from Youku. The top 2 ranked programs, "Seelook" and "Larva in China S2," are slapsticks, with Mango TV's exclusive "Grizzy and the Lemmings" also in the same category. Additionally, "VIP Pets," "Ricky Zoom," and "True and the Rainbow Kingdom" performed remarkably well.

*Annuel Performance Index: A comprehensive measure of views, comments, searches, and trend in Series

International Coproduction: Youku leads with diverse global partnerships

In 2023, Youku had 18 self-produced or co-production programs go live, 7 of which were joint productions with overseas animation companies: including the “Lupin’s Tales” new seasons co-produced with France's Xilam driven and coordinated by Midolala; the "Tina & Tony" series with Russia's Riki Group; the "True and the Rainbow Kingdom" series co-produced with Guru; and "Turbozaurs" with Cyprus's Treblo Media.

Tencent Video had 8 co-production projects, only one of which was a collaboration with an overseas company: "Super Potato" from BBC Kids&Family, with the other 7 being domestic co-productions. All 9 children's content productions by iQIYI were domestic.

Overall Performance: Content aimed at girls being the most popular

"Commercialization" is a keyword in the Chinese market in 2023, with all major platforms seeking children's content with strong commercial elements, for a very straightforward reason: high return on investment. So, what type of content was most beloved by Chinese children this year?

Half of the top 10 content comes from Tencent, with iQIYI holding 3 spots, and Youku 2. In the overall ranking of exclusive broadcasts, domestic programs accounted for 8 spots, while overseas programs held 2.

7 spots are occupied by the same genre: content aimed at girls. iQIYI performed exceptionally in this category, with all 3 of its programs being girl-themed and self-produced.

Surprisingly, the types of programs ranked 2nd to 5th are all reality shows: Youku's in-house-produced "Fanny" series and Tencent's introduced "Like Nastya" are particularly noteworthy, and the NO.1 ranked "Monsters in the Forbidden City" also presents a blend of live-action and animation.

Based on market playback feedback, the most popular themes in 2023 were undoubtedly content aimed at girls and kids' reality shows.

Final Thoughts

Overall, 2023 was a better year than 2022, with the budgets and numbers of content acquisitions by various platforms at least maintaining the level of the previous year, even showing an upward trend. In terms of business models, besides acquiring licensing rights, platforms also increasingly value PGC (Professional Generated Content) collaborations under the initiative of "reducing costs and increasing efficiency": sharing ongoing profits with rights holders based on the actual performance of the program.

*Statistic ressource : Youku, Tencent, IQiyi, Mango TV platforms & Nian Tong Kids

Midolala's mission is to maximize your content's revenue and visibility in China through direct sales and PGC distribution, reaching more than 80 platforms.

Midolala's mission is to maximize your content's revenue and visibility in China through direct sales and PGC distribution, reaching more than 80 platforms.

Specialized in business development for kids' content in the Chinese market.

Copyright © 2024 Midolala. All Rights Reserved.

Specialized in business development for kids' content in the Chinese market.

Copyright © 2024 Midolala

All Rights Reserved

Specialized in business development for kids' content in the Chinese market.

Copyright © 2024 Midolala. All Rights Reserved.